The University’s financial report for the fiscal year ended June 30, 2018, published on October 25, revealed a fifth consecutive budget surplus—nearly $200 million—in part reflecting continued U.S. economic growth and the benefits accruing from the $9.62-billion Harvard Campaign (which wrapped up on June 30; see harvardmag.com/campaigntotal-18). The report included an annual message from Harvard Management Company (HMC) chief executive N.P. Narvekar, in which he shed more light on the endowment, following the September news of a 10 percent investment return during fiscal 2018 (details at harvardmag.com/endowment-18).

The financial results, plus Narvekar’s comments on his progress in overhauling HMC to boost returns, help clarify both Harvard’s prospects during favorable conditions and President Lawrence S. Bacow’s perspective, at the outset of his administration, on how to be ready for whatever lies ahead. Having led Tufts during the financial crisis at the end of the last decade, he offers some cautions about how the University with the largest endowment should be on its guard.

Harvard’s Finances

During fiscal 2018, revenue increased nearly $217 million to about $5.2 billion (growth of 4.3 percent): close to the 4.6 percent growth in fiscal 2017, despite restrained endowment distributions—Harvard’s largest source of revenue.

The growth was driven by executive and continuing education, up more than $47 million (about 12 percent—faster than the 8 percent growth logged in the prior year), to $458 million; and non-federal sponsored research grants, up an aggregate $21.5 million (8 percent), to nearly $289 million. (Unfortunately, federal research support was essentially flat, at $453 million for direct costs—and up about $7 million for indirect costs: reimbursement for facilities, overhead, etc.)

The endowment distribution rose by $34 million (just 1.9 percent), to a bit more than $1.8 billion. In light of earlier weak investment returns, the Corporation held the distribution flat (per unit of endowment owned by each school) for fiscal 2018, and suggested that distributions could increase within a range of 2.5 percent to 4.5 percent annually for fiscal years 2019 through 2021, beginning with 2.5 percent in the current year. The increases realized in fiscal 2018 reflect gifts: new endowment units as a result of largess from the campaign. Current-use giving rose, too, by $17 million (3.7 percent), to $467 million—another testament to the socko finish of the fundraising drive.

Other revenue, a catch-all category, also chipped in, increasing $50 million (7.9 percent), to $689 million. A notable contributor was royalties from commercial use of intellectual property (up about $18 million, or 50 percent, but those results can be very volatile from year to year).

Expenses rose by $134 million to just more than $5 billion (2.7 percent)—continuing a moderating trend (up 3.9 percent in fiscal 2017 and 5.3 percent in the prior year). Although some one-time factors affected the results, it appears that deans, expecting level endowment distributions, reined in their spending.

Compensation—salaries, wages, and benefits—accounts for half of expenditures, and rose only 2 percent: less than half the rate of growth in fiscal 2017. Salaries and wage expense increased 3 percent, also decelerating from the prior year; and employee-benefit costs were unchanged.

There is a bit of accounting noise in that number. Expenses for employee benefits such as retirees’ defined-benefit pensions and healthcare costs are adjusted annually for changes in the prevailing discount rate. In fiscal 2017, those adjustments increased costs significantly. In fiscal 2018, the interest-rate adjustment (and favorable claims experience) decreased costs, a significant swing in results. In both years, health-benefits costs for active employees—the major benefits expense—rose a reported 4 percent, reflecting more people covered and higher claims costs.

All other expenses increased by an aggregate 3 percent. Space and occupancy costs rose an apparent 10.5 percent, to $410 million. Some of that reflects the University’s torrid construction program (see below) and larger facilities, such as the expanded Kennedy School campus. But the fiscal 2018 figures apparently reflect one-time costs for environmental abatement.

A continuing saving occurs on the “interest” line. Following the refinancing of Harvard’s debt in October 2016, interest expense declined $33 million in fiscal 2017. Now, that benefit has been in place for a full financial year, resulting in a further $15-million reduction (to $188 million) in fiscal 2018. Those savings persist in the future. (Following the financial crisis in 2008, Harvard was forced to borrow $2.5 billion to stabilize its balance sheet and secure access to liquid funds, driving annual interest costs to $299 million; that cost has since decreased by more than 37 percent. This reduction in interest expense has contributed significantly to the University’s five-year run of surpluses.)

The result was an operating surplus of more than $196 million—contradicting, in all the ways that make financial officers happy, the message sent last year that the $114-million surplus reported then might well be the “high-water mark for the foreseeable future.” This fifth consecutive surplus means that the schools have accumulated resources which may come in handy as reserve funds when conditions are less favorable—or may be applied to their teaching and research missions in coming semesters.

Finally, the balance sheet and capital spending merit mention. As noted, expenses for operating and occupying buildings have risen as Harvard has conducted the largest capital-spending program in its history, reaching a record $908 million during fiscal 2018. The highlight projects are the Smith Campus Center and Klarman Hall at Harvard Business School (HBS), now open (operating costs for which will show up in the fiscal 2019 results); the Allston science and engineering center and power plant, coming on line in the fall of 2020; Lowell House’s renewal and successor projects; and the renovation of the Soldiers Field housing adjacent to HBS.

The completion of some of those major projects, and further House renewals, likely mean that the University will borrow more funds soon. Interest rates have been rising. Hence the importance of managing down debt outstanding (currently $5.3 billion, down from $5.4 billion in fiscal 2017) and refinancing higher-cost obligations when possible during the past several years.

The Endowment: Risk and Return

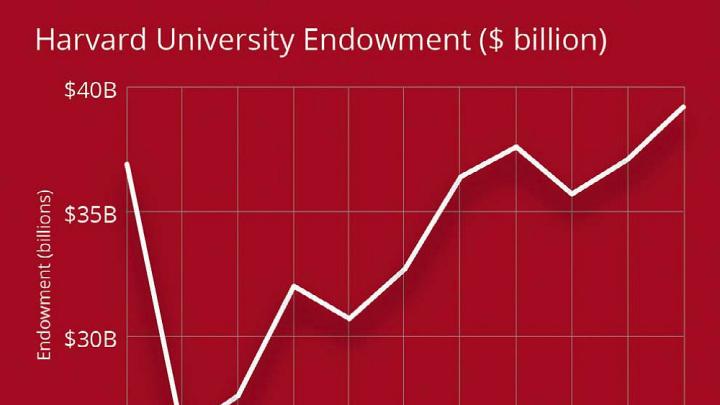

In his report on the endowment, valued at $39.2 billion last June 30, Narvekar provided some of the asset-class information HMC had published annually before his arrival in late 2016. Although he emphasizes the unified, generalist way HMC now makes investment decisions for the endowment as a whole (in contrast to the siloed, by-asset-class model he has discontinued), he published rough allocations and returns by category, as shown here.

Harvard Management Company data, from Harvard University Financial Report, Fiscal Year 2018

Narvekar disclosed last year that HMC had taken significant losses on its natural-resources portfolio, disposing of assets and marking down others. It also sold various real-estate and private-equity holdings then—and continued to do so in fiscal 2018. A review of this year’s financial-report footnotes reveals within the general investment account (which includes the endowment) an appetite for foreign, global, and emerging-market stocks, compared to the end of fiscal 2017; decreased holdings of U.S. and high-yield bonds (not surprising with rising domestic interest rates); and a multibillion-dollar increase in hedge-fund investments and commitments to invest in the future, plus a lesser increase in private-equity assets.

Assessing the results, Narvekar wrote: “First, there are certain parts of the portfolio that need work,” now under way (notably: managing the downsized natural-resources portfolio and perhaps tweaking some private-equity holdings; and, presumably, repositioning the cohort of hedge-fund managers). “Second, looking beyond the returns of individual asset classes, asset allocation—or risk level—was the dominant factor in the overall returns. In general, the higher the risk level, the higher the return.” That might suggest HMC’s portfolio, in transition, suffered on a relative basis because its assets were not yet allocated ideally, in his view. (Many peer institutions reported returns higher than HMC’s 10 percent fiscal 2018 result; their risk profiles and investment objectives differ, of course.)

He observed, further, that “as sophisticated investors well know, there are very limited conclusions that we can draw from a single year of either manager performance or asset allocation.” Thus, “Had this past year’s return been significantly higher or lower, it still would not be reflective of the work we are undertaking, nor change the path we are pursuing. This is a reality that will apply to the remaining years of our transition as well.”

Refining his description of that transition, Narvekar wrote that those significant changes “require a five-year timeframe to reposition the organization and portfolio”—a message he has underscored continuously. But he added a phrase about “subsequent strong performance.” For those who may have missed the subtlety, that suggests that remaking HMC and activating its new investment disciplines; refining its risk framework (involving at least a two-year collaboration with HMC’s board and the University, to begin soon); reestablishing relationships with superior external fund managers; and getting them money to invest, are all encompassed within that five-year transition—after which the harvesting of presumably superior results should show up. That is the nature of investing in long-term, illiquid assets, where those higher risks and returns reside over time. But it is also the nature of achieving superior returns over the course of an entire investment cycle. Doing so is critical to the definition of HMC’s aim, as he put it, to “ensure that Harvard University has the means to continue its vital role as a leader in teaching and research for future generations.”

HMC’s generalist team is in place (perhaps a couple of dozen people: senior leaders, investment specialists, and supporting analysts), and Narvekar cited as an “especially welcome discovery” that “HMC has an extraordinarily talented, skilled, and dedicated team on both the investment and support sides,” making it “well within our capacity to effect this turnaround and generate long-term success for Harvard.”

In the near term, it would not be surprising if there are more bumps in the road, perhaps in the runoff natural-resources portfolio. Those discussions with the University about its appetite for risk are crucial, too. Is Harvard’s traditional expectation of an 8 percent annual return attainable (see harvardmag.com/distribution-16)—and if so, at what level of risk? Is a single pool of assets appropriate for separate Harvard entities when their dependence on endowment distributions varies from 85 percent of annual operating revenues to 51 percent to 17 percent (the Radcliffe Institute, the Faculty of Arts and Sciences, and the public-health school, respectively)? How does the University sort that out, given its autonomous schools? And how does managing the endowment to profit from robust markets while minimizing losses during downturns line up with the shorter time horizons of individual deans?

Being Prepared

Usefully, those questions will be addressed under the ultimate direction of a leader who has lived through the severest investment cycle in memory.

During a conversation at Massachusetts Hall on November 2, President Bacow outlined some of his perspectives on these issues. In general, he said, universities fortunate enough to enjoy endowments take risks in their budgets that turn out to be highly correlated with the risks in their investment portfolio. Thus, when the economy is weak and the value of assets depressed, schools relying on endowment distributions typically have to spend more on financial aid, cope with less current-use giving, and face reduced support for sponsored research. And of course, if they seek to rein in costs, half or more of which are for their people, there is resistance to layoffs; attrition diminishes as employees have fewer opportunities elsewhere; and retirements slow because those eligible worry about diminished savings.

In other words, all the enormous benefits derived from endowment distributions mean that “endowments are not a cushion in tough times.” And in general, Bacow said, at most universities, governance of the endowment is separate from governance of the operating entities and functions. That makes it easy, and dangerous, for administrators and deans to proceed without appreciating the correlation. (Hence the importance of that discussion about risk that Narvekar highlighted.)

Moreover, the more heavily endowed the institution, the greater the mismatch. Thus, Tufts derived 12 percent of its revenues from endowment distributions during the 2008-2009 financial crisis and recession: a 25 percent decline in its endowment translated, roughly, into a 3 percent adjustment to revenue—a haircut about one-third as severe as that faced by Harvard and Yale, which were three to four times as endowment-dependent. Bacow rebooted the Tufts budget in one year. In contrast, he said, the multiyear process of smoothing out the losses at Harvard protracted the period of constraint, even as external conditions improved. That was challenging for morale—and perhaps tangibly, too: Tufts was able to get back in the hunt sooner to hire faculty members from institutions that were still cutting back.

Bacow was an Eagle Scout before he was a university president. Unsurprisingly, he wants to be prepared, so he is working with the deans, he said, on planning scenarios for the economic downturn that will surely come.

Similarly, vice president for finance Thomas J. Hollister, Harvard’s chief financial officer, and treasurer Paul J. Finnegan, a member of the Corporation and chair of HMC’s board, were relatively restrained in their letter accompanying the annual financial report (which reflected performance prior to the beginning of Bacow’s presidency). In light of Harvard’s surpluses—a good problem to have—they gently reprised their warning from the prior year, that “higher education has matured as an industry. Revenues are under pressure as the number of students has plateaued, tuition costs have reached limits of affordability, federal research support is uncertain, and expectations for returns in the investment markets are muted.”

The University, they noted, “is well positioned to manage through this period due to a healthy balance sheet, modest recent operating surpluses, established financial discipline, and Harvard’s primary strength—faculty and staff—who create one of the world’s most exciting learning and research environments. Nonetheless, the University is cognizant of economic pressures” and of the need to prepare “for an inevitable economic downturn, particularly in light of the current extended economic expansion—one of the longest in history.”

Many visitors to Harvard Yard delight in the antics of the resident squirrels. Within the surrounding buildings, a squirrel’s-eye perspective on the wisdom of storing up acorns is very much in fashion.