Bill Gates ’77, LL.D. ’07, and Mark Zuckerberg ’06, LL.D. ’17, famously created their companies, now Microsoft and Facebook, as undergraduates. And then they took their ideas, and the resulting riches accruing to two of the planet’s most financially successful companies, to the West Coast. Will successor generations of world-changing enterprises come from Harvard—and if so, how will they be funded and developed, and what role will the University play? Those questions are addressed in part by the existence of facilitating programs, like the Allston-based iLab and the Technology and Entrepreneurship Center (TECH) embedded in the School of Engineering and Applied Sciences (SEAS). And, perhaps surprisingly, they are also addressed by a venture-capital fund, with an East Coast office in Harvard Student Agencies (HSA) and advisers that include SEAS faculty members and, ex officio, the school’s dean, the iLab director, the student president of HSA, and others—all with the aim of helping liberal-arts entrepreneurs launch start-ups after graduation.

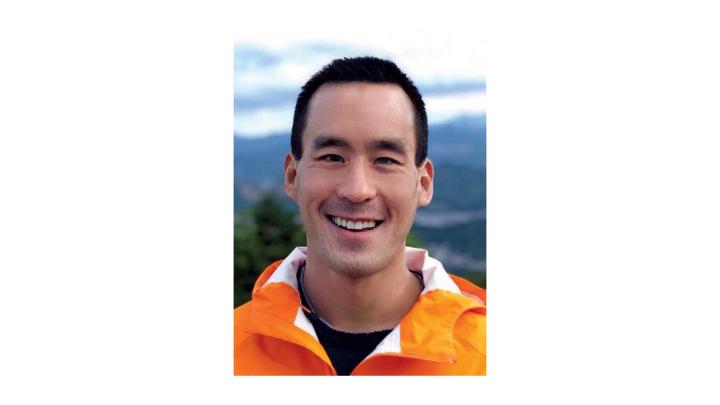

Despite the many Harvard connections, including alumni among its investors, the Xfund, a seed-stage venture-capital firm founded at Harvard nearly a decade ago, operates independently of and without funding from the University. The firm has raised more than $225 million since 2012, including a third, $120-million round of funding this fall. And it has invested in numerous start-ups, including the artificial-intelligence-driven search and data-analysis firm Kensho (acquired by S&P Global for $550 million in 2018); the world’s largest online residential real-estate rental platform, Zumper; the fertility and pregnancy products company Natalist; and the genomics-based personal-health company 23andMe, among many others. Originally named the Experiment Fund, and housed in an SEAS office, the firm was seen by Cherry Murray, then dean, as a way of differentiating the new school from its peers, says Xfund partner Patrick Chung ’96, J.D.-M.B.A. ’04. Initially, its creators had envisioned supporting only Harvard affiliates. But Murray—now Pierce professor of technology and public policy and professor of physics emerita, and still an Xfund adviser—urged a more inclusive approach. The fund has thus been open to “everyone” since its inception, Chung says, establishing about a 10 percent ownership stake in start-ups launched by students, faculty, staff, and alumni of colleges and universities around the globe, from its offices in Cambridge and Palo Alto.

Notably, 33 percent of the firm’s capital is invested in companies with women founder-CEOs. (Nationally, less than 3 percent of all venture-capital dollars is invested in such start-ups.) When immigrant and minority founders are added, that proportion rises to 72 percent of investments. Chung says the firm does not explicitly look for racial, ethnic, or gender diversity, and attributes this result to Xfund’s efforts to reach founders with more liberal-arts-focused backgrounds. “In an increasingly technocratic world, most venture-capital firms will not want to talk to you if you did not major in computer science or engineering,” he says, fields that have historically had difficulty attracting women. “We take the opposite approach.” During his last visit to Stanford, for example (in February 2020), his presentation was delivered not at the school of engineering, but at the humanities center.

Kensho founder Daniel Nadler, who is also an acclaimed poet, was a postdoctoral fellow in economics, teaching at Harvard and planning an academic career, when the fund approached him, after being tipped off by one of his students to Nadler’s proprietary business-intelligence search tool. Claudia Laurie ’18, an art-history and computer-science dual concentrator, said that as she sought investors to launch her “marketplace intelligence-based pricing and discounting” start-up Prive a few months ago, many potential funders were wary of investing with founders who were not experienced software engineers. But the Xfund was supportive, and after the firm became Prive’s lead investor, the start-up’s funding round was soon oversubscribed. Natalist founder Halle Tecco, M.B.A. ’11, who has worked with Chung for more than a decade, says his energy and drive are “contagious. He winds you up in a good way.”

Beyond its interest in atypical founders, the fund is unusual in another respect: “We have a double bottom line,” Chung says. Most venture-capital firms are focused solely on financial returns. But because of the fund’s history, and its more than two dozen faculty and student advisers from leading academic institutions, Chung says the firm also aspires to an educational mission, “to teach students, faculty, alumni, and staff what it means to start a company, and how that might or might not be a path for them to choose.” Even when a professor refers a student entrepreneur whose interests lie outside the bounds of Xfund’s portfolio (its investments are 40 percent in consumer goods and services, 40 percent in enterprise software, and 20 percent in digital health care), the principals pledge to educate those nascent founders about the process, and point them to the right investors.

There is a deeper mission, too, says Chung. Many Harvard undergraduates are the first in their families to attend college, and those students often feel “immense pressure to take safe, high-paying jobs as management consultants or investment bankers on Wall Street” rather than pursue the risky path of launching a new enterprise. He sees the Xfund as means of creating opportunity for such graduates (the fund does not invest in currently enrolled students’ enterprises). “Bill Gates and Mark Zuckerberg were from well-to-do families. They could afford to take risks. Our goal,” he says, “is to change the risk balance so that students don’t have to choose between a job at Google and becoming CEO of the start-up they’ve dreamed about since they were a kid.”